kansas automobile sales tax calculator

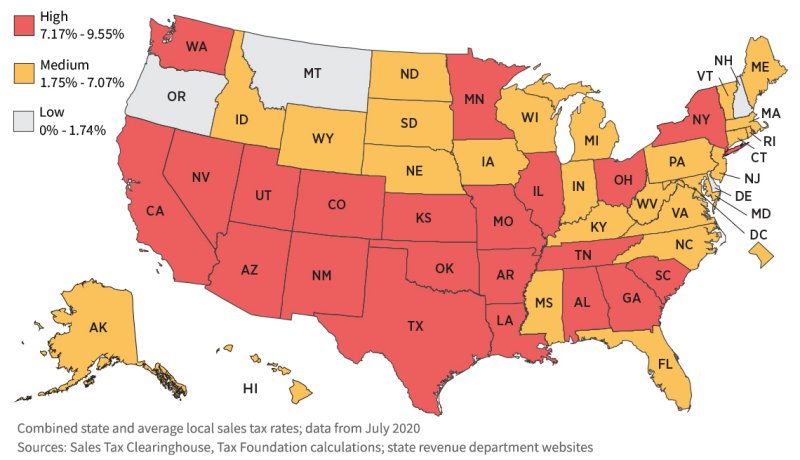

This means that depending on your location within Kansas the total tax you pay can be significantly higher than the 65 state sales tax. 635 for vehicle 50k or less.

Kansas Income Tax Calculator Smartasset

Missouri Car Sales Tax Calculator.

. The minimum combined 2021 sales tax rate for johnson county kansas is 948. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. The johnson county sales tax rate is 148.

Find your state below to determine the total cost of your new car including the car tax. You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. DO NOT push any buttons and you will get an information operator.

Home motor vehicle sales tax calculator. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Kansas automobile sales tax calculator Saturday March 5 2022 Edit.

Kansas has a 65 statewide sales tax rate but also has 377 local. With a population of more than 585000 johnson county is the largest county in kansas. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. If this rate has been updated locally please contact us and we will update the sales tax rate for Marion County Kansas. Subtract these values if any from the sale.

There is no special rate for topeka. Vehicle Property Tax Estimator. Multiply the vehicle price after trade-ins andor incentives by the sales tax fee.

The sales tax rate for Marion County was updated for the 2020 tax year this is the current sales tax rate we are using in the Marion County Kansas Sales Tax Comparison Calculator for 202223. The median property tax on a. To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator.

You pay tax on the sale price of the unit less any trade-in or rebate. Other 2021 sales tax fact for kansas as of 2021 there is 165 out of 659 cities in kansas that charge city sales tax for a ratio of 25038. The sales tax rate varies by county.

Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property tax by makemodelyear VIN or RV weightyear for a partial or full registration year. The state sales tax rate in kansas is 650. 1 Manufacturers rebates are now subject to tax.

You cannot register renew or title your vehicles at the Treasurers office located in the County Administration Building in Olathe. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation districts.

Vehicle Property Tax Calculator Estimate vehicle property tax by makemodelyear or VIN. A Recent changes in sales taxation of motor vehicle sales and leases. Motor Vehicle Office Locations.

Motor Vehicle Office Locations. This will be collected in the tag office if the vehicle was purchased from an individual or out-of-state car dealer. How 2022 Sales taxes are calculated in Kansas City.

The Kansas Department of Revenue and its staff make no representations warranties or guarantees express or implied about and assume no responsibility for the use of the Tax Calculator and expressly disclaim liability for any damages resulting from or arising out of the use of reference to or reliance on the Tax Calculator and this Tax. The minimum is 65. Vehicle Property Tax Estimator.

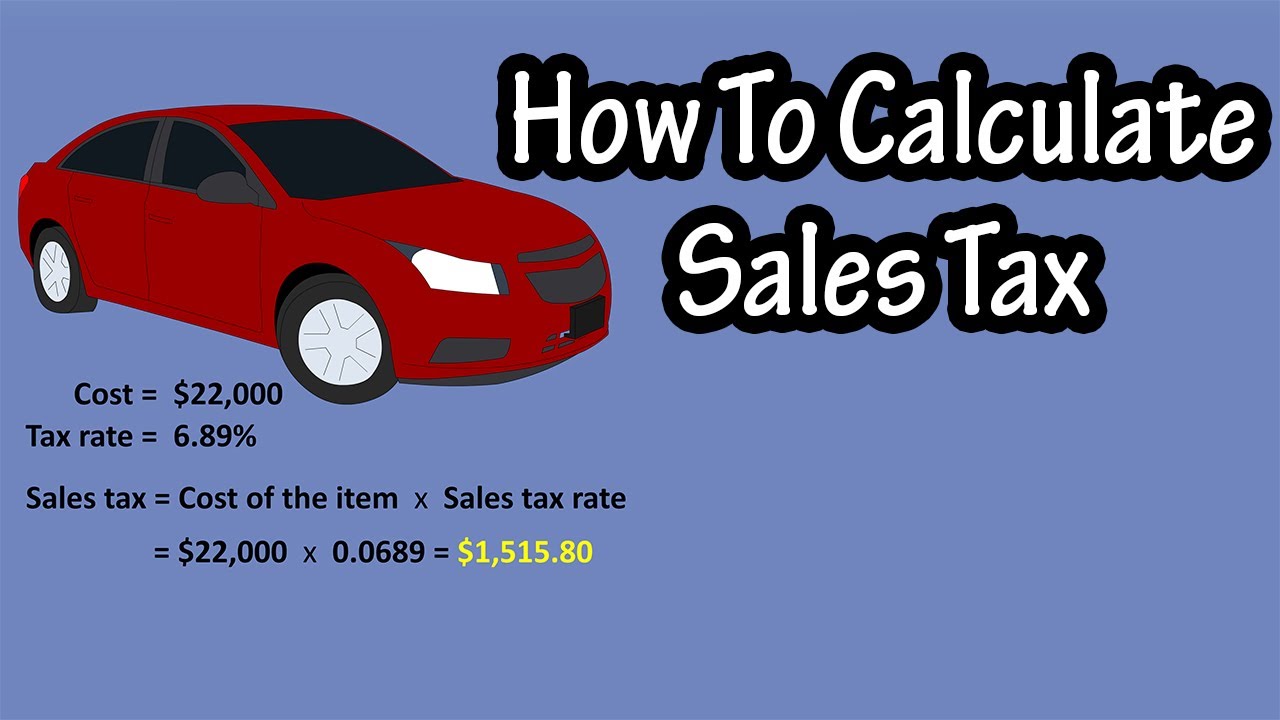

For example imagine you are purchasing a vehicle for 45000 with the state sales tax of 65. From July 1 2006 through June 30 2009 KSA. How to Calculate Kansas Sales Tax on a Car.

This will start with a recording. You can find these fees further down on the page. There are also local taxes up to 1 which will vary depending on region.

Find your state below to determine the total cost of your new car including the car tax. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Go to IRSgovOrderForms to order current forms instructions and publications.

For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000. The IRS will process your order for forms and publications as soon as possible. Choose a search method VIN 10 character minimum Make-Model-Year RV Empty Weight And Year.

Motor vehicle titling and registration. Kansas has a 65 statewide sales tax rate but also has 531 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1979 on top of the state tax. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator.

In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Kansas auto sales tax calculator. Vehicle Tags and Titling What you need to know about titling and tagging your vehicle.

There are also local taxes up to 1 which will vary depending on region. This will start with a recording. Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Car Tax By State Usa Manual Car Sales Tax Calculator

Tennessee Sales Tax Calculator Reverse Sales Dremployee

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Nebraska Sales Tax Small Business Guide Truic

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Sales Tax On Cars And Vehicles In Kansas

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Missouri Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Kansas Vehicle Sales Tax Fees Find The Best Car Price

States With Highest And Lowest Sales Tax Rates

Car Sales Tax In New York Getjerry Com

What S The Car Sales Tax In Each State Find The Best Car Price

Kansas Estate Tax Everything You Need To Know Smartasset

Motor Vehicle Fees And Payment Options Johnson County Kansas